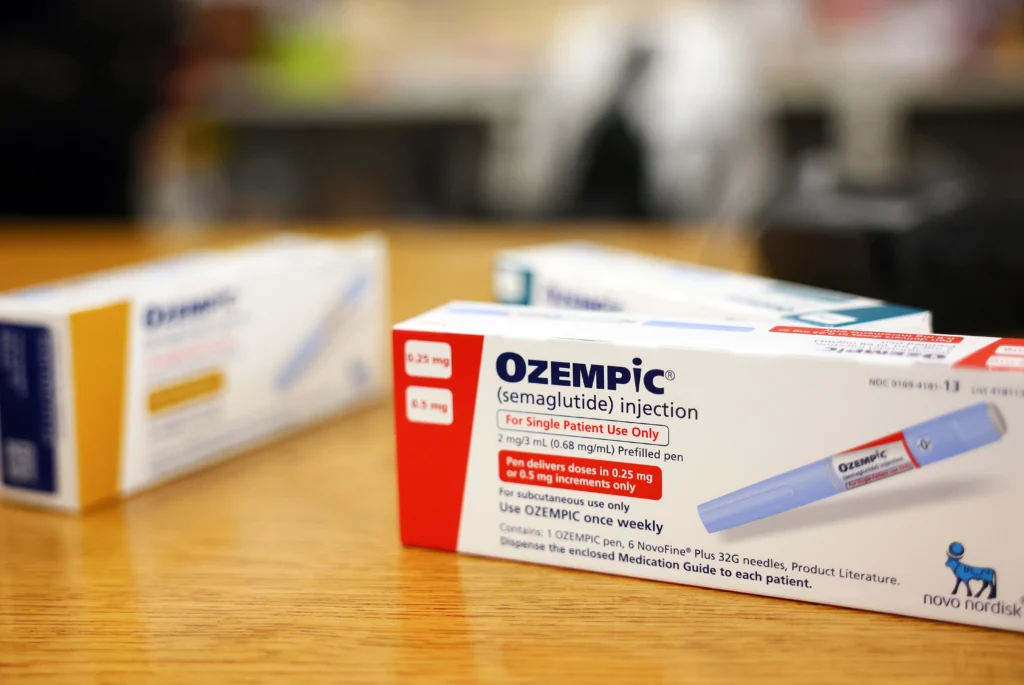

Uncover the Real Story Behind Insurance Denials: Find out why Ozempic and Mounjaro aren’t covered by most plans and how misleading insurance promises can leave you frustrated and confused.

Think Your Doctor’s to Blame? Think Again: Discover why the approval process isn’t as simple as a quick call and how only certain rare insurance riders might make weight-loss coverage possible.

From Anger to Action: Learn how to navigate the limitations of insurance and explore realistic options for accessing weight-loss medications without relying on elusive insurance approvals.

Let’s get real about something that infuriates a lot of my patients: insurance coverage for weight-loss medications like Ozempic and Mounjaro. If I had a dollar for every time someone looked at me in frustration because their insurance won’t pay for these drugs, I’d probably have my own private jet by now. Speaking of jets, let me break down why dealing with insurance can sometimes feel as ridiculous as trying to get them to cover a flight to the Bahamas.

As a doctor specializing in pain management and wellness in SoHo, I spend a lot of time demystifying the insurance process. The misunderstanding usually starts here: Patients are under the impression that all their doctor needs to do is get a prior authorization, and voila! Their insurance will cover Ozempic or Mounjaro. Unfortunately, it’s not that simple, and the confusion is understandable—insurance companies aren’t exactly known for being transparent.

Here’s the reality: Unless you have insulin-dependent diabetes and can prove you’re on insulin, your insurance company won’t cover these medications. They might never outright tell you that they won’t cover Ozempic for weight loss. Instead, they’ll leave you hanging with vague promises, saying things like, “Oh, if your doctor gets authorization and proves it’s medically necessary, we’ll cover it.” It sounds promising, right? Wrong. It’s like saying, “Sure, we’ll cover that private jet if your doctor deems it medically necessary.” Technically, it’s true, but the odds are slim to none.

The real catch? Insurance companies aren’t in the business of making medical decisions. They can’t say a drug is necessary or unnecessary—that’s a liability nightmare, and they’d be sued to high heaven. Only your doctor can make medical decisions. But what they can do is create a maze of requirements, making you think that the power to get coverage lies solely in your physician’s hands. So, when your medication gets denied, it’s easy to think your doctor didn’t do enough.

Here’s the frustrating part for people looking to use Ozempic or Mounjaro for weight loss: Even if your doctor sends in a prior authorization, unless you have insulin-dependent diabetes, the request will get denied. There’s a glimmer of hope with Semaglutide—if you can prove obesity, about 10% of insurance plans might cover it.

But here’s the catch: Your insurance plan needs to have a “weight loss rider,” an extra-expensive insurance option that some high-end employers (think big banks) might offer. If your employer didn’t buy this additional coverage, you’re out of luck.

I get it. It’s maddening. Patients often feel that if only their doctor had done “more,” they wouldn’t be shelling out of pocket. But believe me, as a physician, I’m bound by ethics. I can’t submit false information or say you have a medical condition you don’t actually have.

So, where does that leave us? At Fild Studio, my practice in SoHo, we offer a monthly subscription service for weight-loss medications like Semaglutide or Trapezide. Depending on your dose, the cost ranges from $400 to $700 per month. We’ve got around 2,000 happy patients on these plans, and while it’s not cheap, it’s a predictable, straightforward option that many find invaluable.

Look, I know it’s not the perfect solution, but it’s an honest one. If you’re tired of the insurance runaround, we’re here to help. Book a consultation at Fild Studio, and let’s find a way forward that puts your health and well-being front and center.

Ready to take control of your wellness journey? Schedule your appointment today.

[uap-landing-commission slug=’author_1′]